what happened to the stock market february 2018

Information technology was the scariest twenty-four hours on Wall Street in years.

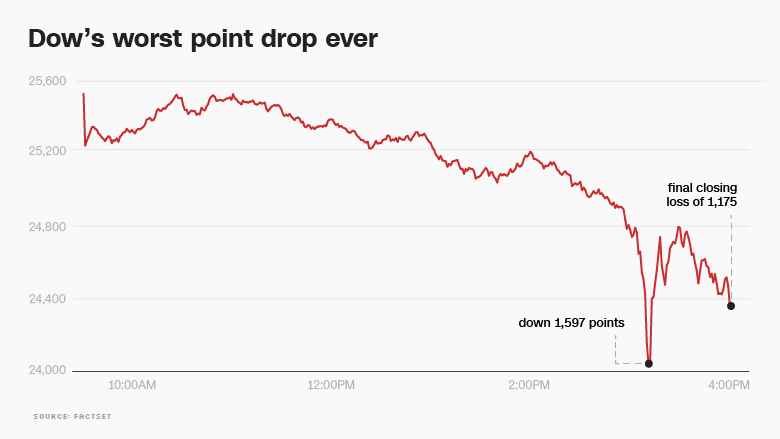

Stocks went into costless autumn on Monday, and the Dow plunged near ane,600 points -- easily the biggest bespeak turn down in history during a trading 24-hour interval.

Buyers charged back in and limited the damage, but at the closing bell the Dow was nevertheless down i,175 points, past far its worst closing point decline on record.

The drop amounted to 4.6% -- the biggest decline since Baronial 2011, during the European debt crisis. Simply it was nowhere shut to the destruction on Black Monday in 1987 or the fiscal crunch of 2008. Still, for investors lulled to slumber past the steady upward climb since Election Solar day, information technology was alarming.

And the rout in U.Southward. markets continued to ripple effectually the earth. Japan's Nikkei index plunged 4% in Tuesday morn trading while the Due south&P/ASX 200 in Australia dropped iii%.

The White House said in a statement that President Trump was focused on "our long-term economic fundamentals, which remain exceptionally strong." The statement cited strengthening economic growth, depression unemployment and increasing wages for workers.

The trouble in the market began early on last week, when investors focused on a number of lingering concerns.

If the economic system gets much stronger, it could impact off inflation, which has been mysteriously missing for the nine years of the mail-crunch recovery. That could force the Federal Reserve to raise interest rates faster than planned.

"People are dealing with the daze of seeing existent inflation for the first fourth dimension in a while," said Bruce McCain, main investment strategist at Key Individual Bank.

The sell-off wiped out the Dow and South&P 500 gains for the twelvemonth, and left the Nasdaq barely in positive territory for 2018.

Related: Market commotion puts Trump in a tough spot

Investors have also been nervously watching the bail market, where yields have been creeping higher. As yields rise, bonds offer better returns, which makes them more than bonny to investors compared with risky stocks.

Stocks sank throughout the solar day, then went off a cliff in the terminal hr of trading. The Dow was down 800 points at 3 p.m. Within minutes, it was down 900, i,000 -- and then 1,500 points. At its depression, the Dow was down 1,597 points, earlier buyers rushed in and limited the pass up.

The Nasdaq slumped more 2%, speedily turned positive, and so sank once more. It finished down most 4%. The S&P 500, a broader judge of the market than the Dow, declined more than four%.

The plunge pushed stocks closer to what'due south called a correction, or a 10% decline from their well-nigh recent high betoken. The S&P 500 is downwards almost 8% from its all-time high.

"The stock market is throwing a tantrum," said Andres Garcia-Amaya, CEO of wealth management business firm Zoe Financial.

"Take a deep jiff," said Garcia-Amaya. "I know information technology'due south been a while since we had a twenty-four hour period like today, merely nothing has really changed from a central standpoint."

The market started 2018 with a bang, simply terminal week was the worst on Wall Street in two years. The selling gathered steam on Friday when the Dow plunged 666 points, or 2.5%, at the fourth dimension its worst day since the Brexit mayhem of June 2016. Nearly $ane trillion of market place value was erased from the Southward&P 500 final calendar week.

"Y'all had a market that was overbought and ripe for something to undermine its placidity," said Mark Luschini, primary investment strategist at Janney Capital letter.

The VIX volatility alphabetize, a measure out of market place turbulence, skyrocketed a tape 116% on Monday to the highest level since August 24, 2015, the last fourth dimension the Dow plunged 1,000 points in a mean solar day. The spike signifies how at-home Wall Street had been -- and how unprepared the markets were for trouble.

CNNMoney's Fright & Greed Index is flashing "fear," underlining a major shift in marketplace sentiment from a week ago when it was sitting in "farthermost greed."

The Russell 2000, an index of smaller stocks that have heavy exposure to the U.S. economy, turned negative for 2018 for the commencement time.

"Valuations got stretched and that led to a cascading event today," said Sam Stovall, chief investment strategist at CFRA Research. "The market has to right itself -- a resetting of the dials -- earlier this bull market can continue."

Related: Good news for Master Street is freaking out Wall Street

Investors' main concern is the sell-off in the bond market place. The x-year Treasury yield, which moves opposite price, spiked to a 4-twelvemonth high of two.85% on Friday. It'due south a dramatic swing from two.4% at the start of 2018. College yields could make unremarkably deadening bonds look more bonny when compared with risky stocks.

The U.S. economy is healthy. Friday'due south jobs report showed that wages grew at the fastest stride since 2009. That's a welcome shift by workers who accept been dealing with anemic raises for years.

Has your paycheck gotten bigger thanks to the new tax nib? Volition information technology make a difference? If so, what will y'all do with the actress money? Tell us virtually information technology hither.

Yet, Wall Street is starting to get worried that the "goldilocks" environs of tedious growth and mysteriously depression inflation may be ending. Besides the fear of faster inflation and interest-charge per unit increases, more robust wage gains could eat into record-loftier corporate profits.

No matter the cause, the stock market was long overdue to have a breather. Before Fri, the S&P 500 had gone the longest stretch e'er without a three% pullback. At present the Southward&P 500's record-long catamenia without a five% retreat is in jeopardy.

Related: This is why the Dow is plunging

While they tin can be scary, market pullbacks foreclose stocks from overheating and give investors who were stuck on the sideline a risk to get in. Janet Yellen, who but stepped down as Fed principal, told PBS on Friday that she still believes "asset valuations generally are elevated."

Despite the recent turmoil, the Dow remains up about forty% since President Trump's election. The robust operation has been driven past strong corporate profits, healthy economic growth and excitement near the Republican tax cut for businesses.

Analysts at Bespoke Investment Group urged at-home.

"Take a deep breath," the firm wrote in a inquiry note on Friday. "For those investors that may accept forgotten, this is what a market reject feels like."

The question is whether the market retreat deepens or whether investors buy at the dip, a mentality that has supported stocks for months.

"The fundamentals of the economy remain quite stiff," said Janney's Luchini. "It's hard to make the case for why nosotros should be down more than than 10% -- unless we encounter negative economic news."

Key Banking company'due south McCain agrees. "We believe this is not the first of the cease and a tilt towards a carry marketplace. It's premature for that," he said.

Wells Fargo suffered some of the worst of the selling on Monday. The No. 2 U.S. banking concern plunged 9% subsequently unprecedented sanctions were handed down by the Fed late Friday.

--CNN's Liz Landers contributed to this study.

Source: https://money.cnn.com/2018/02/05/investing/stock-market-today-dow-jones/index.html

0 Response to "what happened to the stock market february 2018"

Post a Comment